1. Inequalities in the Urban Built Environment

For the delivery of the urban built environment, the business model derived from neoclassical economics has provided a working framework that harnesses the productivity potential of scale and of skill specialization through the process of private real estate development. More specifically, within this framework, the growing predominance of the production of buildings in most metropolises globally is being performed as a speculative economic activity: that is, by definition, when the developer provides the necessary resources – funding, expertise, and management – to create built forms for utilization by other urban participants in return for rental or purchase payments. This overtly transactional or commercial purpose of the development process, being in contrast to that historic venture of building for one’s own use either for production or consumption, is that which substantially drives the economic activity by which most of the urban environment is created in today’s rapidly growing cities, and is accepted as a normative component of the evolution of towns and cities.

While the rapid urbanization currently underway and facilitated by this private economic mechanism is often acclaimed as progress, there is also extensive evidence that better living conditions are not being provided equitably for all urbanites: rather, there has evolved a striking contrast in the surfeit of excessively-priced residences, workplaces and recreational opportunities against the severe lack of affordable housing for the average worker, the displacement of lower income residents and artistic entities requiring moderately priced workspace, the removal of public open space and amenities, and the rising community dissatisfaction with these consequences. Perhaps this pervasively used model of delivering the built environment needs to be re-examined?

2. Urban Real Estate Development Literature Review

As an area of scholarly investigation, the intrinsic dynamic of the real estate development process – in its comprehensive inclusion of society’s land use, physical form of the “improvements”, the financial and economic drivers, the community impact, and the symbiotic relationships between these disparate aspects – is remarkably neglected, with most related research occurring within the effectively quarantined, methodological frameworks of various disciplines focused on urban theory, the design form, economic geographies, urban policy, housing economics, or the very specific financial objectives of real estate investment.

The dominant body of current scholarship in the area of real estate deals with the urban development activity as a mechanistic, rational process by which the “utility-maximizers” undertake the production of the asset in response to the supply/demand dynamics formulated by neo-classical economics and, in the detailed analysis of the outcome, as an investment asset. It specifically applies the tools of property financial analysis as derived from the Capital Asset Pricing Model (CAPM)[1] utilized by corporate finance. Excellent theoretical evolution within this paradigm has provided the (almost) globally adopted form of investment return analysis that supports the transactions related to the $27 trillion of real estate investment properties worldwide, and also delivered the core textbooks utilized within real estate educational programs of the highest levels (for example, Brueggeman and Fisher 1977; Geltner and Miller 2000).

In earlier days of scholarship, specifically focusing on the development process within this conceptual framework, Kaiser and Weiss (1970) had initially proposed that the fundamental laws of supply and demand drove the development process and developers were seen to make their most important decisions based on perceiving and interpreting market signals with the actual development process, once begun, proceeding in a relatively self-organized manner. By this process real estate development was seen to achieve a suitable built form bringing with it the accepted and underwritten status of an investment asset. However, after a couple of decades, this analytical approach was beginning to be seen as flawed by Guy and Henneberry (2000) for its inability to consider, include, or analyze any set of coherent socio-spatial imperatives arising as a result of that Capitalist-system-based process.

Attention to the topic, however, from the field of urban theory with its ontological inclusion of the social dimension has proceeded haltingly, perhaps as it wrestled with the pervasive neo-classical framework just described, and how such an analytical methodology might be incorporated, or should be, within its own complex theoretical framework, even as its conceptual structure transformed substantially over the past few decades. Initially, addressing the rapid development activity of the mid-twentieth century in Britain and the USA (and also Canada and Australia), some significant progress was made to establish structural theories and institutional models to guide, evaluate and professionalize the development process and relate it to the urban context. An early pathway was insightfully laid out by Fraser (1984) and Soja (1989) who both took the neo-classical economic model as the main object of criticism and contention and proposed a more socialist-based framework for urban development.

More focused on the motivations of the actors within urban society, though also utilizing the lens of macroeconomic analysis, have been the models that are described as either “Structure Models” by Healey (1991: 232) or “Production-based Approaches” by Gore and Nicholson (1991:721), but which typically emerge from the application of Marxist principles to the process of production, that is, positing that the very construction of the built environment is similar in its politico-economic fundamentals to any commodity production. These models of the development process referenced emerging paradigms of urban theory such the urban land nexus (Scott 1980), followed by assemblage theory (DeLanda 2002, Latour 2005) as it sought to encapsulate the sequence-based approach of development activity within a structured framework that observed the dynamics and activities of the participants and markets with respect to their relationships of power, or influence in decision-making, thereby adding a much welcomed socio-economic assessment to the descriptions of the process.

Proceeding in parallel and dispensing with neo-classical economics and fully pursuing the application of the Marxist thesis with direct reference to the struggles between the landowner, production capital and labor, Boddy (1981) devolved the real estate development process into three “circuits of capital” – “industrial capital”, “commercial capital”, and “interest-bearing capital” – and by imposing the dynamics between these three forms of capital on the event-sequence model of the development process (Healey 1991), he established a theoretical construct that facilitated observation of the outcome for the built environment of the development process as being directly consequential to the capital-based relationships that exist within, evolve throughout, and ultimately dominate the delivery of developed property.

However, the scholarship that approached urban development within the most comprehensive dimensionality comprising the economic, the social and, adding in detail, concern with the spatial is most probably best exemplified by David Harvey (1978, 1985). As with Boddy (1981), he examined the process through the Marxian lens of economic production, but also exposed the significant politico-economic conflicts at the heart of the socially and spatially dysfunctional outcomes that had been frequently occurring during the accelerated urban expansion of the 1970s and 1980s. Significant in his model is Harvey’s emphasis on the capital flows with their potential for substantial variation in the timing and quantum, and the effects of this on the economic and spatial structure. An approach that adopted this production meta-theory but sought to examine the details of the workings of the various entities in the development process is that of Ball (1986:158), who presented both the production and consumption of housing as activities of what he termed “provision” which, by definition, goes beyond the mere physical delivery and basic transaction to include social actions and consequences which may be partially connected with the economic aspect, such as in terms of affordability, or even with the physical nature in terms of the aesthetic quality or societal symbolism of the buildings created.

Further advancement of this development theory within the urban context was made by Beauregard (1994, 2005) who challenged the “reductionist and functionalist approach to property markets that collapses all property sectors – housing, office, hotel, industrial, retail and so on – into a market logic of supply-demand relationships”, and also presented the inadequacy of the neo-classical economic model of demand, supply and market signals as utilized by the most prominent researchers in urban economics over the prior two decades (Bateman, 1985; DiPasquale and Wheaton 1996; Thrall 2002). Beauregard (2005:2432) further describes such a “market logic” model as “thin” in their abstraction of the behavioral responses by various agents in the urban development process and general application across the different property types and locations, and he advocates for the model of development or redevelopment to be “thick” in its incorporation of the actual variations in the behavior of developers, financiers, local authorities, local communities and business interests.

However, as this new model was emerging, a significant change was occurring in the dynamics of the capital at the core of the urban development process. In addition to the flow of capital into real estate that provided for the housing, workspace, retail, social or recreational needs of an urban community, the early part of the twenty-first century saw an acceleration in the more highly speculative form of developments, such as luxury apartments, soaring iconic office buildings, etc. that were neither needed nor, in many cases, desired by the local inhabitants. The speculative capital driving these developments did not follow the same rules of allocation, timing and returns with respect to supply and demand analysis as the regular investment capital that had been mostly responsible for building contemporary urban environments during the twentieth century: this new development funding was rationalized as “seeking a safe harbor”, serving the purpose of global diversification, and various other newly-popular investment objectives.

Additionally, with the arrival of the twenty-first century, the impact of property development activities on urban environments has been noted as a global concern. While needing the formation of cities to provide the centers of scientific, cultural, economic and social innovation (Glaeser 2011), the surge in urban growth has also resulted in concentrated poverty, ethnic and social conflict, ecological crises, the unaffordability of housing, and homelessness (Storper and Scott, 2016), and thereby increasing the challenge for effective urban theory. Within the resultant debate of urban theorists, the attention to the development process itself has been loosely attached to the various formulations of assemblage theory (Latour 2005; Farias and Bender 2010; Simone 2011), followed by postcolonial theory (Roy 2009; Sheppard, 2014), and more recently adding a predominant attention to gentrification by Mukhija and Loukaitou-Sideris (2014), and Haila (2017).

These more comprehensive, social-context-including models have been successful in presenting the development process as relevant and even critical to the socio-economic construction of urban areas, with some flexibility and adaptation for global application. However, in strengthening that dimension, it might seem that they have moved even further away from constructive engagement with the underlying neo-classical economic context that continues to dominate the critical financial decisions almost universally inherent in urban development. However, and perhaps being equally problematic methodologically, as mainstream financial structuring in support of the real estate developer and investor has become more sophisticated and extensive in its analytical underpinnings, it still fails to provide a framework for assessing the outcome from the perspective of an urban community, its residents, workers and visitors, and their interest in equal access to all aspects of the built environment.

The reasons for this startling and increasing dissociation between consideration of the process of property development with its long-lasting and extensive consequences for urban environments and the short-term, transactional focus of the underlying financial dynamic are many and varied: ranging from the relatively recent dominance (globally) of the private real estate development business model and the apparently attractive reliability of the advancing financial structures of the capitalist system, to the age-old problem of silos of academic disciplines with varying theoretical underpinnings and purposes. However, the consequences of this lack of a comprehensive, critical investigation of the real estate development process, particularly as a private sector business activity within the very vulnerable socio-economic context of the city, are now rudely confronting contemporary societies from political levels through to the average urban worker’s struggle for economic survival, with the inequality of access to shelter being a sizable, urgent and socially dangerous representation of such injustice.

3. Reframing the Problem of Inequality in the Urban Built Environment

The discussion of the stark inequalities found so consistently in urban communities currently occupies scholars from many fields including health and welfare, justice and criminality, employment and wages, and others of social and economic dimensions, but also the built environment and urban planning. Most influentially, John Plender (2016) addresses the socio-economic inequality pervasive in urban environments and places the problem within a wider historical context of moralizing about markets, reviving Marx's predictions and those justifications of capitalism’s decent, in addition to commencing a discussion of the evolution of entrepreneurship within this broader framework.

Amongst the urban theorists, various perspectives have been adopted ranging from Haila (2017) in developing economies to that of Florida’s (2017) exposition of the “New Urban Crisis” in the USA. Typical of many, this latter dissertation provides extensive and very informative quantitative and comparative descriptions of the unequal development of urban environments in the U.S. and he posits that the fundamental urban principle of agglomeration (Glaser 2011) as mixed with the innovative industries of his identified ‘creative class’ has led to exacerbating income inequality and ‘winner-take-all’ urban consequences such as residential unaffordability and spatial segregation. As pointed out by Beauregard (2017), Florida’s argument, although purportedly to be about ‘contradictions’ follows the typical narrative of ‘how economic and political power divides the spoils of growth and decline’ and calls upon the (assumedly responsive and efficient) patrons of policy to overcome inequality with the usual tools of more infrastructure, affordable housing, increased minimum wages, and building resilient cities, which Beauregard terms ‘recommendations to no one’. Nor does it address the actual process of real estate development in building the physical representations of this inequality, reinforcing the politico-economic structures favoring such an outcome, and harnessing the tidal flows of capital pertaining to this economic inequality.

The challenge therefore remains to take the mainstream economic model that supports the real estate development activity and synthesize it with the emerging investigations of the socio-economic consequences of urban development currently undertaken by urban theorists structured within the Marxist framework. Overcoming the historically held perception that these two paradigms of economic analysis are irretrievably conflicted and opposed – they each generally blame the other structure for the adverse consequences – would not be easily achieved but is fundamentally necessary because of the shortcomings in interrogative coverage by each.

4. Piketty’s Proposition

Arising outside of the arena of urban theory but serendipitously addressing this challenging gap in urban economic analysis, the French economist, Thomas Piketty (2015), delivers a striking proposition: that socio-economic inequality is a consequence of the fundamental principle of capitalism whereby, barring catastrophic events, accumulated wealth invested for the return on capital achieves an ever-rising share of the broader economic benefits than that represented by income obtained through the contribution of labor or skills.

He commences his construction of such an argument by noting that in the earlier, historic times, especially for hundreds of years in Europe, a fundamental economic contrast existed between those who owned the land that was the basis for agrarian production, and therefore were in an advantaged position, and those who labored in that production but were without ownership of any other resources (often even their tools) and were therefore disadvantaged economically. Subsequently, as he points out, with the more capital-intensive modes of production of the industrial era, this economic dissonance was exacerbated, eventually giving rise to specific attempts for redress through revolutions, workers’ unions, and Marxist political theory.

Playing the most simple and transparent role in the persistent direction of increased income to capital rather than to labor, Piketty proposes, is a fundamental dynamic whereby, when the general rate of economic growth is low, it is exceeded in magnitude by the rate of return on invested capital. He expresses this as:

r > g where r represents the rate of return on capital and g represents the rate of growth of the broad economy. (Piketty 2015:25)

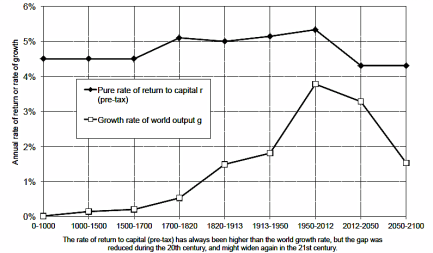

When this occurs, as it has done through much of the history of western capitalism until the 20th century, and more recently in the period since the Global Financial Crisis, the inequality rises, favoring with higher returns on their respective resources those with the capital to invest over those with only labor to offer. He underscores this by demonstrating that, in contrast, when economic growth is above historically average levels such as in the middle part of the 20th century, the inequality of returns was reduced, though he also credits the loss of wealth through wars, economic crashes, etc. as components of that rebalancing. This divergence of growth rates with respect to rates of return on capital throughout history is shown in Figure 1.

Figure 1. Rate of Return versus growth rate at the world level, from Antiquity until 2100 (Piketty 2015: 354).

Through this expose, Piketty’s consideration of socio-economic inequality, also being a concern of many anti-capitalist urban theorists (Harvey 1985; Beauregard 1994; Haila 2017), is most unusually approached by an interrogation of the capitalist system itself, which he accepts as solidly in place, and proceeds with an evaluation largely though its own structural framework. Unusually, he does not adopt an external construct such as Marxism, which has been typically utilized for socially focused analysis, though he does borrow some conceptual formats which most clearly define the socio-economic conditions. By this more complicated methodology, he believes that he will be more effective in adjusting for the better, potentially by policy, some of the constructions within the capitalist system that can be identified as associated with unequal socio-economic outcomes. And, therefore, with an application of Piketty’s theory to real estate, it is suggested that the mainstream economic analysis pervasive in the industry might be reviewed for its structures or contradictions that have subversively generated the inequalities represented in urban built form today.

4.1. Bifurcated Returns

In considering the long history of inequality, Piketty introduces the construct of bifurcation of economic returns of production directed to the ownership, or investor of capital, and those directed to the labor providing the output. This presents distinctly different economic distributions relative to the respective production activities of capital and labor despite that the two activities typically work in combination for the majority of economic production today.

In terms of a theoretical methodology, Piketty’s bifurcated description of the economic contest is purposefully resonant of Marx: a specific paradigm of economic production with the inherent dynamic of dividing the economic returns from production into the income that is directed to the ownership of the land or the industrial, business, or entrepreneurial structures – collectively represented by the capital required for such ownership – and the income directed to the labor, or those providing the output. This derivation of Marx’s capital and labor dichotomy he defines as the “factorial” economic distribution where capital and labor are the two specific “factors of production” in an economy; and, furthermore, he points out that even within these two categories there are additional inequalities in terms of the levels of wealth – between that which is inherited and that which is accumulated – and in the quantum of income earned by labor, for example, the difference in salaries between CEOs and average workers (Piketty 2015:40).

This adoption of the Marxist structure of economic production by Piketty provides for real estate analysis a conceptual framework within which to assume the rigorous and comprehensive models of urban theorists, such as Boddy (1981) and Harvey (1985), which differentiate the capital flows associated with the transactional activities of renting or buying land or completed buildings to utilize in economic production with that capital which is inherent in the investment purpose of real estate. Additionally, as a methodology for real estate analysis, the use of the capital/labor conflict facilitates the incorporation of strong frameworks of city-scale dissertations (Beauregard 2005; Weber 2015; Haila 2017) as an important context for the further, more granular considerations of real estate development projects and their role in urban inequality.

Equally effective in the application of Piketty’s construct to the discussion of real estate is his utilization of the analytical structures of the mainstream, neoclassical economic system since such a financial paradigm continues to drive most real estate activity globally today and for the foreseeable future. While Piketty makes use of concepts such as return on capital, passive investment assets, and real wage growth in discussing macroeconomic dynamics, the analysis of real estate normally uses similar notions of capitalization rates, price appreciation and net operating income to review and evaluate investment activities (DiPasquale and Wheaton 1996; Geltner and Miller 2000; Brueggeman and Fisher 2015). Therefore, the continued application of these commonly accepted tools should prove most efficient in the examination and exposition in decipherable terms of the financial factors that might be associated with inequitable urban outcomes.

However, Piketty’s unique achievement is that he meshes or interweaves these typically opposing analytical methodologies. Although in doing so, he attracts criticism from both theoretical camps, he is able to produce a cohesive and compelling approach that seeks to address the problem of inequality without discarding the omnipresent, neoclassical economic theorem. For real estate, it can be considered that this methodology might also provide a channel of communication that bridges the previously discussed historical conflict between the two predominant paradigms of urban development theory, essentially derived from those overarching macroeconomic methodologies, that has bedeviled any discussion of real estate and the socio-economic consequences. Piketty’s construct provides a useful meta-theory within which real estate can be evaluated with respect to its urban socio-economic impact as framed by current urban theory with its fundamental capital/labor dialectic, but also enables this to be done through a detailed examination of its specific economic dynamics described within the mainstream, neoclassical construct.

4.2. Detailed Real Estate Analysis in accordance with Piketty’s Construct

In viewing real estate analysis and its urban impact in this way, the overarching objective is to interrogate the dynamics of real estate investment analysis in order to uncover where and how certain economic decisions have an impact on the urban context. However, for the purpose of urban impact evaluation, the analysis should also be directed towards the labor/capital dichotomy. Therefore, the mainstream analysis of real estate is used to parse the financial components with respect to returns related to the labor actions within a macroeconomic situation versus those related to the capital investment actions.

While the actual construction of property would seem to be an obvious situation for the discernment of income due to labor (construction workers) and the income due to capital investment (investors and lenders), and this would neatly follow Boddy’s (1981) tripartite “circuits of capital”, this component of real estate, the construction phase, is quite short-lived, mostly occurring at the outset, and therefore represents a minor contribution to the economic production value in comparison with the provision of space for various activities of economic activities, such as those performed by tenants and workers, over the life of the building. Therefore, in seeking to establish the labor/capital dialectic within the analysis of real estate as it operates long-term within an urban economy, it is necessary to interrogate the typical real estate investment return analysis applied to properties over the complete lifecycle, though it effectively minimizes the labor of construction.

Within this methodological perspective, it is perhaps surprisingly found that the existing, neoclassical economic concept of long-term, commercial (non-residential) real estate investment is such that it is fundamentally structured on a certain duality of capital flows: divided into the portion of the whole economic benefit that is attributable to the actual utilization of the property in spatially accommodating production activities by tenants such as manufacturing, office work, retail, etc.,,as distinct from that portion of benefit which is due the storing (and desired increase) of investment asset value which is derived predominantly from the sale of the property.

More explicitly, this bifurcation of economic benefits might be seen to resonate somewhat with a labor/capital dichotomy, if the utilization for productive activity is regarded as the “labor” of the commercial building. Since this provision of space to accommodate activities of economic production by the inhabitants (tenants) is effectively the contribution of a resource (well-located and operational space) to that production, and it is rewarded for this resource by rent payments (“wages”). The economic benefits, on the other hand, that are associated with the “passive asset”investmentare those achieved predominantly by the increase in price, or appreciation, in the property between the time it is acquired and that at which it is sold. (Although some excess annual return might be achieved that could be regarded as above and beyond the justifiable reward for the provision of space in the production process, in practice, this excess income is generally forsaken to annual debt service in leveraging the returns on appreciation, or market forces of supply and demand operate to eliminate this arbitrage.)

Therefore, proposing that the framework of the labor/capital bifurcation be applied, slightly obliquely in terminology but still valid economically, to an analysis of urban real estate, the duality can be defined as follows:

- The “labor” is the utilization of the space, with its attributes of shelter, security, location, environmental performance, etc., for economic production, that being not merely factories but also including the “creative workspaces”, the Class A offices, the lesser quality offices, the studios, the retail, the industrial, and the medical offices that are the settings for today’s productive activities. Additionally, it can be posited that residential properties also have a “labor” purpose in so much as they provide the resource of shelter for workers to revive themselves in preparation for productive activities; however, this purpose is only included to the extent necessary to achieve that functional objective of shelter and does not incorporate the aim of building household wealth (a capital investment purpose) as assigned to it mistakenly with great gusto in recent decades.

- The “capital” comprises the invested or loaned funds that achieve or support the ownership of the property and the economic returns are in the appreciation in price that is achieved over the investment period. Furthermore, in clarification of the differentiation of these returns from the utilitarian returns on “labor”, although it might seem that such price appreciation would specifically correspond to the resource contribution of the building to economic production, numerous real estate studies demonstrate that the changes in the transactional pricing of properties are disassociated from utilization, or even underlying rental rates, and correlate significantly with capital flows, speculative intentions of the investors’ strategies (Derrington 2018), or even whether or not the investor is foreign (Devaney & Scofield 2017).

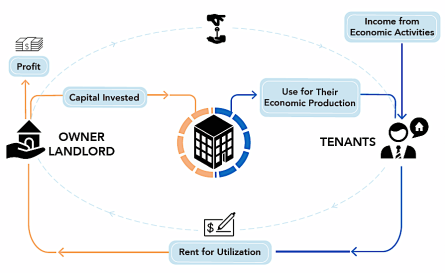

This bifurcated role of real estate and the respective economic returns is represented diagrammatically in Figure 2.

Figure 2. The Bifurcated Functions of Real Estate.

In proceeding with Piketty’s useful meta-theory, it is necessary however to adjust Piketty’s definition of the rate of return on capital. As is typically perceived of real estate, he considers it solely as an investment asset, providing a return on capital and effectively acting as a “passive” asset subject to market valuations for its return on investment: “the rate of return on capital [my underlining] measures the yield on capital over the course of a year regardless of its legal form (profits, rents, dividends, interest, royalties, capital gains, etc.), expressed as a percentage of the value of capital invested” (Piketty 2015:52). However, addressing real estate from within its traditional analytical construct as presented earlier, the income streams and economic benefits can be parsed more finely with respect to the categories of labor and capital.

Although Piketty does miss this distinctionwith respect to urban property, he does make the case for a more nuanced understanding of the capital that plays the utilitarian or “labor” role in real estate. In discussing the notion of the marginal productivity of capital, he is certainly wary of the potential confusion in defining the capital-labor split: “[f]or example, if an owner of land and tools [and home] exploits his own capital [to pay for said land, tools and home], he probably does not account separately for the return on the capital that he invests in himself. Yet this capital is nevertheless useful [in supplying these functional necessities], and his marginal productivity [as applied as his labor, or output] is the same as if the return [or cost of provision and use of these necessities] were paid to an outside investor [or “rentier”, external owner, etc.]” (Piketty 2015:215). However, a discussion of these detailed economics of what is termed “owner-occupied” real estate is not pursued at this time, but is the subject of a subsequent, focused application of Piketty’s theory.

4.2.1. The Bifurcated Income Streams

With respect to these bifurcated roles of real estate, it should also be noted that the capital flows that occur “over the course of a year” (as Piketty describes) are actually associated with its utilitarian contribution to broad economic production and therefore more closely aligns with the function of “labor”, than that of “capital”:

- The capital that the building owner receives in return for providing the space for utilization in the economic production activities of its tenants is derived from the “legal form of capital” known as rents. This capital flow, after paying operating expenses on the property, is reduced to an income stream known as the annual Net Operating Income (NOI) and serves as compensation for the Opportunity Cost of Capital (OCC) to the owner of the capital invested in the property (for its utility purpose) over the associated annual period.

- Such compensation might be paid in the legal form of dividends to beneficiaries if the property is owned through a corporate structure.

- Additionally, real estate acquisitions are most generally leveraged by borrowing under a mortgage loan, with the result that out of the NOI, the lender is paid the interest on that mortgage.

- Furthermore, if the property is a branded hotel or utilizes some specific intellectual property, it might be subject to paying royalties out of the NOI.

By contrast, in identifying within real estate the more nuanced components of Piketty’s “income from capital”, these are, according to traditional return analysis, as derived largely from the appreciation in the market price of the property that occurs between when it was acquired and when it is sold and are not received annually, and must be, by definition of its calculation, monetarily crystallized in a disposition of the asset.

4.2.2. The Bifurcated Returns Provided by the Respective Income Streams

Having parsed the income streams on real estate into Piketty’s labor/capital categories, a further dissection is required of that which he refers to as “returns”. With respect to the proportional economic benefits achieved by invested capital, that is not the actual monetary amount but rather the comparison of that amount to the capital invested and represented metrically as a percentage, he uses the term “return on capital”. However, in his discussion of the economics of labor, he refers only to income levels, that is the compensation or wages in monetary terms, and does not refer to a return on labor; though he does discuss in detail the divergence in wages between workers and executives over the past century. In attempting to compare wages to capital returns, he does proceed to incorporate the notion of increasing wages within the rate of economic growth (as it is handled with respect to the macroeconomic metrics of GDP and inflation), and it is here that he makes his most compelling point with respect to the divergence over time between that growth (in wage levels) and the return on capital investment, with the latter persistently outpacing the former.

It is however within the Marxist conceptual framework that an evaluation is made of the levels of wage compensation for labor with the assessment of being “unfair” indicating a poor “return” on effort expended by the worker. Therefore, in terms of neoclassical economic analysis, although Piketty does not discuss a “return on labor”, in real estate, given the bifurcation of income streams into those “earned” annually by the utilization of the property versus those achieved by the passive investment, a proportional measurement can be made of the former with respect to the funds necessary to provide this utilitarian resource – that is, a “return on labor” is calculated. In evaluating this return due to utilization over a year, the Yield in real estate analysis provides a comparison of the annual Net Operating Income (NOI) on a property, as derived from the rental stream after paying operating expenses, with the amount of money originally paid for it. This is effectively a rate of return on the invested capital achieved by its utilitarian contribution and should compensate fairly for the provision of that resource component of general economic production – it is “capital” performing “labor” as a useful building.

With respect to Piketty’s other return component, the return on (passive) capital, that being capital invested for a return related to the price appreciation, real estate’s duality of capital flows does also provide for a simple proportional metric concerning those flows from the asset. The specific calculation of the rate of return on a real estate investment with respect to its passive increase in asset value is made by comparing the appreciation in value of the property that has occurred (perhaps after having adjusted for inflation to produce a “real” metric), that excess being termed the “profit”, with the original amount of capital invested. The basic equations for this calculation are:

Profit upon Sale = Net Sales Price – Acquisition Price

Return on Invested Capital = Profit/Capital Invested

This profit on the capital invested relating purely to the appreciation in value of the property is often referred to the as the “capital gains” (as also used in Piketty’s definition) on the property, and the comparison of those capital gains with the amount of capital invested can be termed the “Capital Return” within the meta-theory outlined here.

4.2.3. The Total Return on Real Estate

Having elucidated the dual returns from real estate as they reflect Piketty’s bifurcated returns from labor and capital, and noted the respective terminology of those returns as being yield and capital return, a complication occurs in that the most common sophisticated analysis of a real estate investment is made by a calculation of the total return (on the capital invested), combining both yield and return due to appreciation into a single metric. In its fully detailed analysis,a real estate investment is investigated for what is termed the Internal Rate of Return (IRR) which makes a projection of anticipated annual yields for an elected holding period or investment horizon and combines this with the appreciation on the property achieved or anticipated at sale, with all cash flows in the analysis being subjected to an appropriate discounting according to the Opportunity Cost of Capital (OCC) of the investor to adjust for the timing of the funds flows. This total return measure by the IRR is therefore represented conceptually as:

IRR = (Total Annual Yields during the Holding Period + Return on Appreciation)/OCC

This concept of total return does present a complexity with respect to Piketty’s labor/capital dichotomy because for real estate to provide both the utilitarian function and the investment function it uses a common fund of capital (the acquisition price) and involves a singular means (the property) for meeting both economic purposes, that being to achieve both income from “labor” and investment returns for “capital”. This singular resource seemingly differs from Piketty’s concept of labor and capital having different sources, from the worker and the investor respectively.

However, if compared with an operating factory in the typical Marxist framework, whereby the owner of the factory pays for both the machinery and the labor and receives income based solely on the product produced, in this modification for real estate of the funding of economic production, the owner of the property funds the provision of space for the labor of the tenants and receives income derived from those tenants’ productive activities, be they manufacturing, office work, services, retail, entertainment, etc.. It is a slightly different dynamic of payments but similarly a combination of funding of the physical asset with an external labor component but, in the case of real estate, the income provided to the owner is, although effectively derived from the rewards of economic production, the compensation only for the use of the space and does not include that contentious “surplus” to the owner derived from labor in the Marxist analysis. Should rental rates be seen by the tenants to be “surplus” to the productive value of the space provided, they will move to cheaper premises. Therefore, despite the concept of a combined total return analysis that may tend to muddy the evaluation of real estate with respect to Piketty’s labor/capital dichotomy, its composition of the two, distinct forms of capital flows and return metrics enable its economic dynamic to be mapped to his construct.

5. Divergent Returns Lead to Persistent Inequality

Returning to Piketty core proposition with respect to inequality: he maintains that the higher increases in income to capital in contrast to labor is related to the fundamental dynamic of capitalist economies whereby, when the general rate of economic growth is low, it is exceeded in magnitude by the rate of return on invested capital.

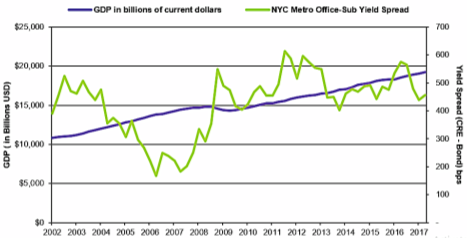

With respect to real estate, it is the yield, or return on the utilitarian function of the property, that tracks general economic growth since it is based on actual income earned on the use of the property, derived from current rental rates as they respond to the broader economy. This correlation can be demonstrated by considering the more utilitarian buildings of the New York City suburban office market with respect to the GDP of the USA as shown in Figure 3 below. This correlation specifically excludes the so-called “trophy assets” of Manhattan that have been shown to be purchased based on anticipated price increases rather than current yield.

Figure 3: New York City Office – Suburban market Yield Spreads generally tracked around general Gross Domestic Product growth between 2002 and 2017, with some expected aberration during the excessive boom and bust occurring 2006-2009 and a correlation coefficient 0.34. RCA data.

In contrast, with respect to those Manhattan CBD Class A office buildings there was found to be a very weak inverse correlation of -0.13 between their Yieldsand GDP, with various studies (Chichernea, et al. 2008; Real Capital Analytics 2017) having demonstrated stronger correlations with supply/demand dynamics and capital flows, respectively.

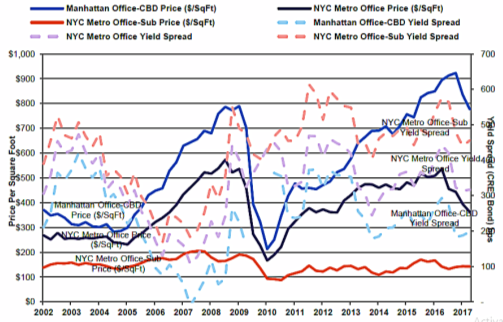

Therefore, in seeking to compare the returns on real estate with respect to its return on capital as reflected in its appreciation in price versus its annual returns, or yield, Figure 4 below shows the comparison for New York City office properties with the markets of the Manhattan CBD, the NYC Metropolitan Area, and the NYC Suburban broken out. For the Manhattan office market, where the predominance of real estate investments were made between 2002 and 2017, the rise in prices that would deliver high levels of appreciation significantly outpaced the increases the yield, or annual returns on the utilization of the space.

Therefore, despite being more erratic, the general historical pattern over the long term for the appreciation of commercial property has been that it exceeds general economic growth rates and provides a substantial, additional return to the owner that can be categorized as return on invested capital.

Figure 4. The correlations between Prices and Yields on office properties in the Manhattan CBD, NYC Metro Office, and NYC Metro Office–suburban areas. RCA data

5.1. Applying Piketty’s Construct to the Study of Inequality in the Urban Built Environment

With Piketty’s direct reference to the ownership of land being at the heart of the early beginnings of economic inequality, soon followed by the ownership of the industrial factories, it quickly calls to mind the question of whether or not the essential ownership of property, and how this ownership is leveraged and rewarded, might be somewhat related to the stark socio-economic inequality represented in the urban built environment today. Furthermore, if the role of the land or the factory in economic production, with its divergent benefits to those that own versus those that toil upon or within, is extended to an analysis of urban real estate and its bifurcated roles,, the current stark inequality in the provision of urban “shelter”, such as most obviously evidenced by the lack of affordable housing (for labor) in contrast to the proliferation of luxury apartments (for capital investment),the framework posited by Piketty regarding socio-economic inequality is pertinent.

Undertaking some introductory empirical utilization of the bifurcated classification of capital returns in the investigation of the inequitable situation in the urban built environment, Derrington (2018 forthcoming) presents the contrast in the return performance between the Manhattan CBD Class A office market, as a proxy target for returns on capital investment, and the New York City Metro Suburban area office market, as representing a target for yield investors. The results demonstrated that the capital seeking investment returns, as a result of price appreciation, does not have the interest in the (more moderate) annual returns or yields delivered by the properties with basic utilitarian functions such as Class B or C office buildings, moderate-rate apartments, necessity retail, or such. As a result, an abnormal proportion of real estate capital was directed to the development or acquisition of the “trophy” segment of the New York City office market, particularly from 2010 through 2017. An adverse consequence of such predominance of capital flows to “investment properties” has meant that less investment and development has been undertaken in the more utilitarian segment of the commercial and residential markets. Consequentlythose industries requiring low base production costs, such as the garment industry, makers, and artists, are being forced out of Manhattan; and workers requiring moderately priced housing are displaced from the “gentrifying” areas. Just as Piketty (2015) warns of the potential societal concerns emanating from the increasing macroeconomic Capital/Income Ratio, similarly the imbalanced flow of capital into certain property components of an urban environment, with others being neglected, might be at risk of provoking community unrest, such as is found in the growing opposition to luxury developments in major cities.

6. Conclusion

Does the underlying market-based dynamic of real estate activities in the capitalist economy inevitably result in unequal outcomes for an urban environment? Or, is the private property development process capable of including a more balanced resolution between the financial benefits of building production and the desired equitable socio-economic use and provision of habitation in today’s cities?

To address these questions there is the need for a theoretical framework that affords both a deeper and more nuanced understanding of the capitalist urban economic structure by which the built environment is most commonly delivered and a rigorous construct by which the socio-economic outcomes can be interrogated with a view to informing that private business model of development, its participants, and those who seek to influence it. Given certain twenty-first century theoretical explorations by Beauregard (2017) and Weber (2015) that acknowledge the persistence of the neo-classical model in the production of the urban environment, but also incisively identify its analytical short-comings or the imbalance of motivating forces, respectively, the stage is set for potentially useful cross-paradigm investigations of urban development. Additionally, the mainstream tools of financial analysis applied to real estate have been simultaneously expanded and refined by scholars providing more granularity to the evaluations of real estate return performance and market trends and, together with more extensively reliable data collection, more incisive elucidation of the inherent economic variables and factors underlying the market cycles.

While there has been some criticism and discussion of Piketty’s assumptions, technical and moral, in his treatise Capital in the Twenty-First Century, he does tenaciously and effectively produce a framework for investigating socio-economic inequality within the capitalist system as it exists that is very pertinent and applicable to investigating the stark inequality of habitation in the urban built environment. With his reference to the Marxist split between “labor” and “capital” in an historical presentation of the inequality of returns and the consequential potential for political leverage and sustained status of each respectively, Piketty’s economic bifurcation is useful in considering the purpose, returns, and contributions of real estate:

- Firstly, in providing the utility of shelter, the “labor” of the property, with the moderate financial compensation – the annual yield as derived from rents – and as such intertwined with broad economic growth; and,

- Secondly, in acting as a store of value or increase in wealth through the passive appreciation in the price of the property in response to the investment market, rather than by its utilitarian function, and achieved over the long-term holding period with crystallization at the point of sale, and termed the return on investment “capital”.

This bifurcated framework of economic analysis affords a new and explicit possibility of interrogating the distinct nature of those returns, how they occur in the market place, who benefits, and what types of properties are favored and those not.It provides a efficient methodology for elucidating the dynamics of how economic inequalities become manifest, in urban real estate development.

Piketty investigates inequality even more precisely with his proposition that generally in history the rate of return on the investment of capital, denoted by r, has exceeded the rate of growth of the broad economy, denoted by g, and is presented as r > g. In this paper, his comparison of these metrics has beenexplicitly related to the economics of real estate: his “r” or return on capital mapped to the anticipated return on the value appreciation or capital gains of the real estate investment, and the “g” or growth of the broader economy as a proxy for wage growth is mirrored in real estate by the annual yield on the utilization of space which inherently increases in relation to that broader economy as demand for space increases or decreases. Similarly, though subject to some additional industry-specific cycles, the returns on invested capital in real estate have historically been higher than those of the yield, and this disparity has been particularly pronounced during economic booms. Consequently, the diversion of real estate capital to the higher returning property types (and locations) means that the moderately priced parts (buildings or districts) of an urban built environment are neglected in terms of investment. And furthermore, it is found that certain new development, such as affordable housing, has been undersupplied in many urban areas in favor of the delivery of luxury housing and, without any municipal intervention, pricing for even moderate housing has soared.

As an early foray into an integrated study of the financial returns of the real estate development process and the socio-economic consequences, this paper unfolds Piketty’s key understandings of the capitalist system and its inherent inequality, and maps those concepts onto an investigation of the economic subsystem of urban real estate development and ownership, seeking to elucidate the specific dynamics of that system which lead to the current situation. Although, at this early stage of such theoretical application, specific proposals for constructive intervention in this system are not presented, the general direction for a more detailed investigation and analysis that seeks effective intervention is indicated.

Acknowledgements

This research did not receive any specific grant from funding agencies in the public, commercial, or non-for-profit sectors.

References

Ball, M. (1986) .The built environment and the urban question. Environment and Planning D: Society and Space, Vol. 4, pp.447-464. https://doi.org/10.1068/d040447

Bateman, M. (1985), Office Development: A Geographical Perspective, St Martin’s Press, New York: USA. https://trove.nla.gov.au/work/18596428?q&versionId=21830977

Beauregard, R.A. (1994).Capital switching and the built environment: United States, 1970-1989, Environment & Planning A, Vol. 26, pp. 715-732. https://doi.org/10.1068/a260715

Beauregard, R. A. (2005) “The Textures of Property Markets: Downtown Housing and Office Conversions in New York City”, Urban Studies, Vol. 42, No. 13, pp. 2431-2442, December 2005.

Beauregard, R.A. (2017 forthcoming) Review of Florida, R. “The New Urban Crisis”. https://doi.org/10.1080/00420980500380345

Boddy, M. (1981), “The property sector in late capitalism: the case of Britain” in Dear, Michael and Scott, Allen J., editors, Urbanization & Urban Planning in Capitalist Society, Methuen Press, London, UK. https://www.taylorfrancis.com/books/e/9781351067997/chapters/10.4324%2F9781351068000-11

Brueggeman, W. B. and Fisher, Jeffrey D. (1977). 1st edition; 2015 15th edition) “Real Estate Finance and Investments”, McGraw-Hill/Irwin, New York, NY, USA. https://www.academia.edu/12863670/Real_Estate_Finance_and_Investments_14th_ed_By_Brueggeman_Fisher

Chichernea, D. et al. (2008) “A Cross-sectional Analysis of Cap Rates by MSA”, Journal of Real Estate Research, Jul-Sept 2008; 30(3), pp.249. https://www.researchgate.net/publication/228180899_A_Cross-Sectional_Analysis_of_Cap_Rates_by_MSA

Derrington, P. (2018, forthcoming) “Chasing Speculative Returns In The Post GFC Recovery: Yield Versus Price Appreciation In Real Estate Investment Objectives”, American Association of Geographers Conference Proceedings, April 2018. https://aag.secure-abstracts.com/AAG%20Annual%20Meeting%202018/abstracts-gallery/12536

DiPasquale, D. and Wheaton, W.C. (1996), Urban Economics and Real Estate Markets, Prentice Hall, Englewood Cliffs, NJ, USA. https://www.worldcat.org/title/urban-economics-and-real-estate-markets/oclc/646029584

Farias, I. and Bender, T. (eds) (2010), Urban Assemblages: How Actor-Network Theory Changes Urban Theory, Routledge, London, UK. https://doi.org/10.1080/02723638.2013.779486

Florida, R. (2017), “The New Urban Crisis: How Our Cities are Increasing Inequality, Deepening Segregation, and Failing the Middle Class – and What can be Done About It”, Basic Books, New York, USA. https://www.goodreads.com/book/show/26240789-the-new-urban-crisis

Fraser, W.D. (1984), Principles of Property Investment and Pricing, Macmillan, London. https://www.worldcat.org/title/principles-of-property-investment-and-pricing/oclc/654649444

Geltner, D. and Miller, N. G. (2000) .Commercial Real Estate Analysis and Investments. Cengage Learning: USA. https://www.researchgate.net/publication/245702364_Commercial_Real_Estate_Analysis_and_Investments

Glaser, E.L. (2011) Triumph of the City, Macmillan Press, London, UK. https://www.goodreads.com/book/show/9897152-triumph-of-the-city

Gore, T. and Nicholson, D. (1991) “Models of the land-development Process: a critical review” in Environment and Planning A, Vol. 23, pp. 705-730. https://doi.org/10.1068/a230705

Guy, S. and Henneberry, J. (2000) “Understanding Urban Development Processes: Integrating the Economic and the Social in Property Research” in Urban Studies, Vol. 37, No. 13, pp. 2399-2416. https://doi.org/10.1080/00420980020005398

Haila, A. (2017), “Institutionalization of “The Property Mind”, International Journal of Urban and Regional Research, DOI:10.111/1468-2427.12495. https://doi.org/10.1111/1468-2427.12495

Harvey, D. (1978), “The urban process under capitalism: a framework for analysis”, Journal of Urban and Regional Research, Vol. 2, pp. 101-131. https://doi.org/10.1111/j.1468-2427.1978.tb00738.x

Harvey, D. (1985), The Urban Experience, The Johns Hopkins University Press, Baltimore, MD, USA. https://doi.org/10.7202/1018918arCopiedAn error has occurred

Healey, P. (1991), “Models of the development process: a review”, Journal of Property Research, Vol. 8(3), pp. 219-238. https://doi.org/10.1080/09599919108724039

Kaiser, E.J. and Weiss, S.F. (1970), “Public Policy and the Residential Development Process” Journal of the American Institute of Planners, vol. 36(1), pp.30-37. https://doi.org/10.1080/01944367008977277

Latour, B. (2005), Reassembling the Social: An Introduction to the Actor-Network Theory, Oxford University Press, UK. https://global.oup.com/academic/product/reassembling-the-social-9780199256051?cc=tr&lang=en&

Lintner, J. (1965). “The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets”, Review of Economics and Statistics, Vol. 47 (1), pp. 13–37.

Marx, K. (1867), Capital: A Critique of Political Economy Vol.1. https://doi.org/10.2307/1924119

Mossin, J. (1966). Equilibrium in a Capital Asset Market, Econometrica, Vol. 34, No. 4, pp. 768–783. https://doi.org/10.2307/1910098

Mukhija, v. and Loukaitou-Sideris, A. (eds) (2014), The Informal American City, Cambridge, MA, USA. https://econpapers.repec.org/article/blaijurrs/v_3a39_3ay_3a2015_3ai_3a3_3ap_3a645-647.htm

Piketty, T. (2015).CAPITAL in the Twenty-First Century. The Belknap Press of Harvard University Press, Cambridge, MA and London, England. http://www.hup.harvard.edu/catalog.php?isbn=9780674430006

Plender, J. (2016) “Capitalism: Money, Morals and Markets” 2016 Biteback Publishing Ltd, London, England. https://www.goodreads.com/book/show/25998642-capitalism

Roy, A. (2009), “The 21st-century metropolis: New geographies of theory”, Regional Studies, Vol. 43, pp. 819-830. https://doi.org/10.1080/00343400701809665

Scott, A.J. (1980), The Urban Land Nexus and the State, Pion, London, UK.

Sharpe, William F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk, Journal of Finance, 19 (3), 425–442. https://doi.org/10.1111/j.1540-6261.1964.tb02865.x

Sheppard, E. (2014), “Globalizing capitalism and southern urbanization”, in: Parnell, S. and Oldfield, S. (eds) The Routledge Handbook on Cities of the Global South, Routledge, London, UK. Pp. 143-154. http://www.stellenboschheritage.co.za/wp-content/uploads/Susan-Parnell-Sophie-Oldfield-The-Routledge-Handbook-on-Cities-of-the-Global-South-Routledge-2014.pdf

Simone, A. (2011). “The surfacing of modern life”, City, Vol. 15(3-4), pp. 355-364. https://doi.org/10.1080/13604813.2011.595108

Soja, E. .(1989). Postmodern Geographies, Verso, London, UK. https://www.amazon.com/Postmodern-Geographies-Reassertion-Critical-Thinkers/dp/1844676692

Storper, M. and Scott A.J. (2016). Current debates in urban theory: A critical assessment, Urban Studies, Vol. 53(6), pp. 1114-1136. https://doi.org/10.1177/0042098016634002

Thrall, G.I. (2002). Business Geography and New Real Estate Market Analysis, Oxford University Press, UK. https://global.oup.com/academic/product/business-geography-and-new-real-estate-market-analysis-9780195076363?cc=tr&lang=en&

Treynor, J. L. (1962). Toward a Theory of Market Value of Risky Assets. Unpublished manuscript. A final version was published in 1999, in Asset Pricing and Portfolio Performance: Models, Strategy and Performance Metrics. Robert A. Korajczyk (editor) London: Risk Books, pp. 15–22. https://www.scirp.org/(S(351jmbntvnsjt1aadkposzje))/reference/ReferencesPapers.aspx?ReferenceID=1684641

Weber, R. (2015). From Boom to Bubble: how finance built the new Chicago, University of Chicago Press, MI, USA. https://doi.org/10.7208/chicago/9780226294513.001.0001

How to Cite

Derrington, P. (2018). Property and Thomas Piketty: Casting the Lens of Thomas Piketty’s Capital in the Twenty-first Century on Inequality in the Urban Built Environment. Journal of Contemporary Urban Affairs, 2(2), 90-105. https://doi.org/10.25034/ijcua.2018.4674

This work is licensed under a Creative Commons Attribution - NonCommercial - NoDerivs 4.0.

"CC-BY-NC-ND"